The case in city tycoon Hamis Kiggundu of Ham Enterprises accuses Diamond Trust Bank of illegally debiting over USD34M from his company’s accounts has taken another twist after the Financial Intelligence Authority (FIA) grilled officials of the bank on Monday, about their roles in the matter.

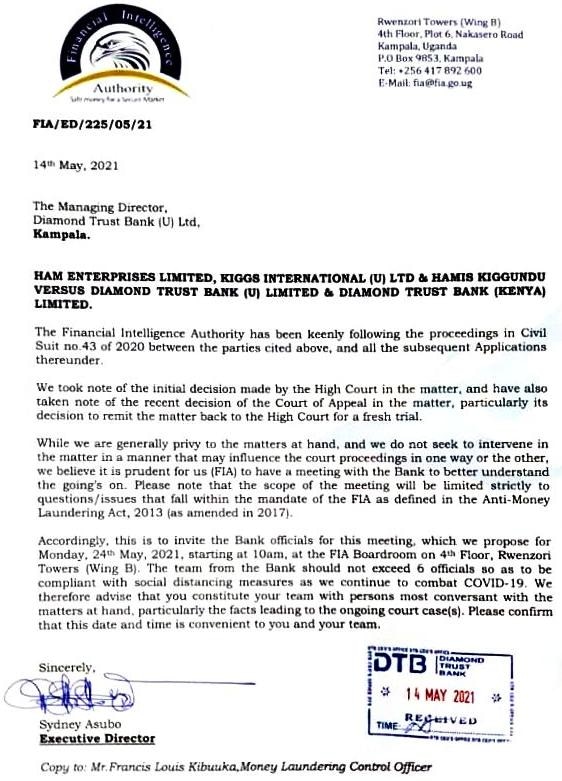

According to a letter seen by this website dated May 14th, 20201, the FIA Executive Director Sydney Asubo summoned the Managing Director DTB and five other officials for a closed-door meeting which was held on Monday 24th, 2021 at the FIA offices, such that they could answer several questions.

According to sources privy to the matter however, the questions that FIA interrogators demanded the DTB Managing Director and his colleagues to answer rotate around tax evasion, money laundering, among others.

Asubo’s letter to DTB, which is titled ‘HAM ENTERPRISES, KIGGS INTERNATIONAL (U) LTD & HAMIS KIGGUNDU VERSUS DIAMOND TRUST BANK (U) LIMITED & DIAMOND TRUST BANK (KENYA) LIMITED,’ reads in part thus;

The Financial Intelligence Authority has keenly been following the proceedings in Civil Suit no. 43 of 2020 between the parties cited above, and all the subsequent Applications thereunder.

We took note of the initial decision by the High Court in the matter and have also taken note of the recent decision of the Court of Appeal in the matter, particularly its decision to remit the matter back to the High Court for a fresh trial.

While we are generally privy to the matters at hand, and we do not seek to intervene in the matter in a manner that may influence the court proceedings in one way or another, we believe it is prudent for us (FIA) to have a meeting with the Bank to better understand the goings on.

Please note that the scope of the meeting will be limited strictly to questions/issues that fall within the mandate of the FIA as defined in the Anti-Money Laundering Act, 2013 (as amended in 2017).

Accordingly, this is to invite the Bank officials for this meeting which we propose for Monday 24th, 2021, starting at 10:00Am, at the FIA Boardroom on 4th Floor, Rwenzori Towers (Wing B). The team from the Bank should not exceed 6 officials so as to be compliant with social distancing measures as we continue to combat COVID-19…”

We have since established that the grilling session was so intense after DTB officials failed to answer many of the questions that were being shot at them by the FIA officials.

It is on record that in his response to DTB SUBMISSION in the Saturday Vision of August 26, 2020 tycoon Ham noted that…. “Let courts of law first determine the case we filed against the Bank for recovery of our money. Then we shall proceed to file cases against individuals, holding them accountable for the fraudulent and money laundering acts that caused unlawful debits of money from our accounts, good enough; Ham Enterprises (U) Ltd being a high-profile client only dealt with top management with both DTB Uganda / DTB Kenya.”

In their arguments in court, Ham Enterprises averred that DTB Uganda and DTB Kenya entered into a loan syndicating agreement well-knowing that such operations were illegal in Uganda, because they are likely to propagate money laundering and lead to tax evasion.

The FIA Act describes Money Laundering as ‘…the conversion or transfer of property; the concealment or disguising of the nature of the proceeds; the acquisition, possession or use of property, knowing that these are derived from criminal activity; or participating in or assisting the movement of funds to make the proceeds appear legitimate.’

The term may also be used to mean Money obtained from certain crimes, such as extortion, insider trading, insider fraud, deceptive transactions, illegal and irregular debits is “dirty” and needs to be “cleaned” to appear to have been derived from legal activities, so that banks like DTB and other financial institutions will deal with it without suspicion.

According to experts at FIA, Money laundering involves three steps:

The first involves introducing cash into the financial system by some means (“placement”); the second involves carrying out complex financial transactions to camouflage the illegal source of the cash “layering” (this is what DTB has over the years been doing to HAM) ; and finally, acquiring wealth generated from the transactions of the illicit funds (“integration”).

This is revealed in the Ham termination letter that shows how “DTB unjustly enriched themselves jointly and severally, through their vigorous, deceptive, fraudulent, and unscrupulous, under regulated, unfair, unjust schemes, using their superior bargaining Position that contracted Ham Enterprises into unconscionable terms of contract.”

DTB’s Money Laundering Scandals

It should be noted that the Ham Enterprises cases is not the only one that endeavours to expose suspicion of money laundering at the Bank, since the bank has been involved in several scandals before.

It is on record that in July 2019, the National Intelligence Service of Kenya investigated Diamond Trust Bank over links to money laundering and terrorism financing.

According to the highly confidential report, the bank had been accused of knowingly aiding terrorism and the authorities demanded an immediate investigation into the allegations and prosecution of senior officials including CEO Nasim Devji.

The group CEO Nasim Devji (Kenya) was subsequently arrested alongside other bank officials for allegedly aiding and abetting terrorism in Nairobi after it was discovered that the terrorists who raided the 14 Riverside complexes in Kenya held an account at Diamond Trust Bank’s EastLeigh branch.

Investigations by the relevant security agencies showed that the terrorists had been withdrawing large amounts to the tune of Ksh50M (About Ugx1.8Bn) prior to the attack, transactions which were never reported to the Financial Reporting Centre (FRC).

The Director of Public Prosecutions (DPP) Noordin Haji said the money withdrawn from Diamond Trust Bank (DTB) Eastleigh branch was wired to Jilib town in Somalia, “which is the headquarters” of Al Shabaab militia and also to Syria to support the outlawed ISIS group.

In the same vein on Thursday March 5, 2020 Kenya’s Chief Prosecutor Fined Diamond Trust Bank Ksh56 million shillings ($542,360) for violating anti-money laundering laws, adding that his office reserved the right to prosecute it in the future.

The charges related to the theft of nearly $100 million from the National Youth Service (NYS). Dozens of senior government officials and business people were later charged in May 2018 with various crimes.

In 2018, the Kenyan Central Bank fined the five banks (Diamond Trust Bank inclusive) nearly $4 million for failing to report suspicious transactions.

As if that that is not enough, in 2015, DTB Kenya, was mentioned as a conduit to siphoning funds from Imperial Bank. This led to the collapse of Imperial Bank, after which DTB expressed interest to take over the bank.

A forensic audit commissioned by Imperial Bank non-executive directors shortly after the death of former group managing director Abdulmalek Janmohammed showed that DTB was one of the two banks that both Janmohammed and his co-conspirators used to move the bank’s funds in the KSh34 billion fraud.

Intelligence gathered by the forensic auditing firm, FTI Consulting, showed that at the time of the collapse DTB held KSh408 million that had been fraudulently moved from Imperial Bank by directors of W.E Tilley (Muthaiga) Ltd, the co-conspirators in the fraud.

Further information showed that DTB was used by the directors of W.E Tilley to lauder proceeds of the fraud.

It should be noted that Ham sued DTB Uganda and DTB Kenya for fraudulently debiting over USD34m from his accounts, under the guise of collecting outstanding loan balances, which he contested.

High Court Justice Peter Adonyo in October 2020 ruled in favour of Ham Enterprises, then ordered both DTB Uganda and DTB Kenya to refund Ham Enterprises all the monies that were deducted from their accounts.

Not satisfied with the High Court ruling, DTB Uganda filed an appeal, which resulted into the court of appeal ruling in May this year which reverted the matter back to the High Court for retrial, on grounds that the trial justice omitted some important aspects in the matter.

Court of Appeal Justices Richard Buteera, Kenneth Kakuru and Christopher Madrama unanimously ruled that Commercial Court judge Peter Adonyo had erred when he faulted the lending arrangement and allowed Ham Enterprises to recover Shs34Bn and $23.2m (about Shs84Bn) from Diamond Trust Bank (DTB) Uganda and Kenya .

Tax Evasion

Given all the above, the overriding question is whether DTB Uganda ever paid any taxes for the Interests arising from their transactions to Uganda Revenue Authority (URA)?

Do you have a story or an opinion to share? Email us on: dailyexpressug@gmail.com Or follow the Daily Express on X Platform or WhatsApp for the latest updates.