KAMPALA, UGANDA: Court in Kampala has issued criminal summons against Prince Karim Al-Husayn Shah, the Founder and Chairman of the Aga Khan fund for Economic Development, and three Diamond Trust Bank (DTB) officials over theft and fraud in the ongoing Ham vs DTB multi-billion case.

Prince Karim, Nassim Muhamed Devji- Group Chief Executive Officer and Managing Director Kenya, Varghesi Thambi- Chief Executive Officer DTB Uganda and John Sitakange- Head of Credit DTB Uganda are accused of illegal and irregular transactions from Hamis Kiggunda’s bank accounts.

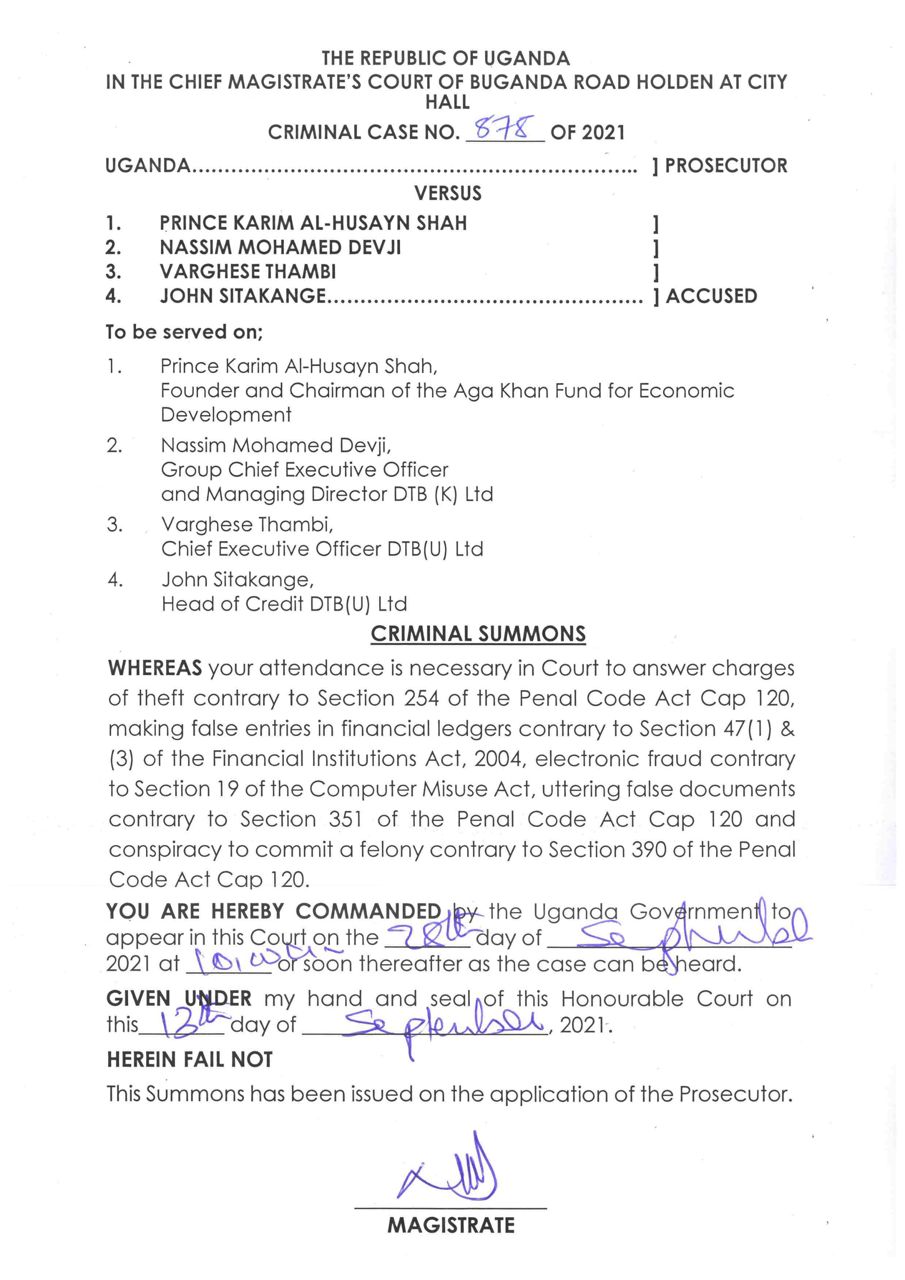

The four are on 28th September 2021 required to appear before Buganda Road Magistrate’s court to take plea on charges of theft contrary to section 254 of the Penal Code Act Cap 120, making false entries in financial ledgers contrary to section 47 (1) and (3) of the financial Institutions Act of 2004.

They are also accused of electronic fraud contrary to section 19 of the computer misuse Act, uttering false documents contrary to section 351 of the Penal Code Act 120 and conspiracy to commit a felony contrary to section 360 of Penal Code Act 120.

According to affidavit, the top bank mangers superintended illegal and unlawful transaction of Shs 34,295,951,553 and $23,467,670 from his bank accounts.

“The above persons who are the directing mind of the bank had knowledge of illegal transactions and they bear criminal liability for the approval and concurrence in committing the deception and fraud on the complainant’s accounts,” reads in part of affidavit.

Kiggunda said that the four do not meet the criteria and they are not fit and proper persons to own, control and mange a bank or any other financial institutions in accordance with the 3rd schedule of the Financial Institutions Act, 2004

In February 2011 and August 2018, Kiggundu sought and offered $4,014,444 and $6,974,600 loans by the DTB Kenya for construction of commercial properties. To secure the loan Kiggundu mortgaged Kyadondo Block 248, Plot 328 land at Kawuku, FRV 1533, Folio 3, Plot 36-38, Victoria Crescent II Kyadondo and LRV 3176 Folio 10, Plot 923, and Block 9 located at Makerere Hill Road.

DTB Kenya contacted DTB Uganda to collect a loan facility from the businessman. However DTB-Uganda insisted that it did not act as an agent of DTB-Kenya to conduct business in Uganda, but only sought its services as a collection agent for it to receive its payments from Ham Enterprises Limited.

In March last year, Ham dragged both banks to court for siphoning over Shs120 billion from his accounts without his consent. He also wanted the court declare that the banks demand for $4,014,444 and $6,974,600, which was advanced to him by DTB-Kenya, is illegal and unenforceable on the grounds that the Kenyan bank had no license to carry out financial business in Uganda.

Kiggundu won the case last October and the Commercial Court ordered that Sh120bn be refunded to his accounts. However DTB appealed the case and the Court of Appeal ordered a retrial in May.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.