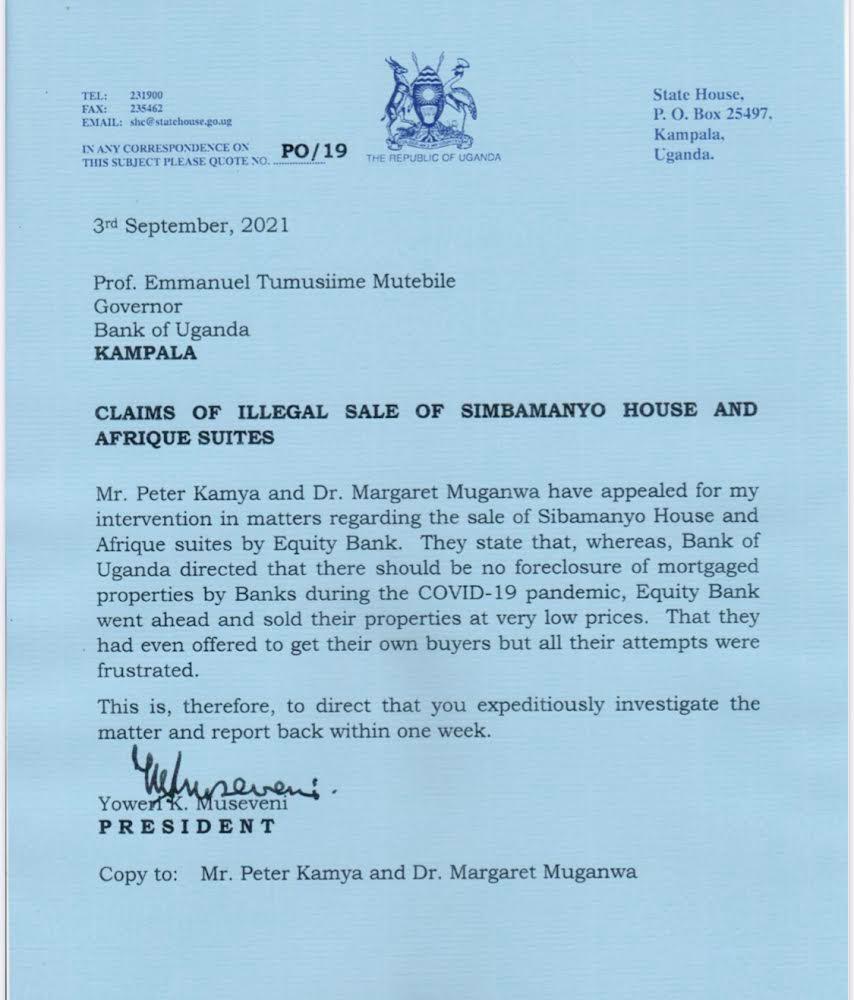

KAMPALA, UGANDA: President Museveni has ordered the Bank of Uganda (BoU) Governor Prof. Emmanuel Tumusiime Mutebile to investigate circumstances under which Simbamanyo House and Afrique Suites were sold by Equity Bank and give him a report within one week.

In his letter to Mutebile dated September 3rd, President Museveni says the owners of the said properties Mr. Peter Kamya and Margaret Muganwa sought his intervention into the matter after they were left frustrated by what they claim was an illegal deal between Mogul Sudhir and the Equity Bank.

“Mr. Peter Kamya and Dr. Margaret Muganwa have appealed for my intervention in matters regarding the sale of Simbamanyo House and Afrique Suites by Equity Bank,” Museveni said in a letter addressed to Mutebile.

The pair according to Museveni’s letter claim they had even offered to get their own buyers but all their attempts were frustrated.

“They state that, whereas, Bank of Uganda directed that there should be no foreclosure of mortgaged properties by Banks during COVID-19 pandemic, Equity Bank went ahead and sold their properties at very low prices,” the president adds.

“This is, therefore, to direct that you expeditiously investigate the matter and report back within one week,” Museveni directed.

Sudhir Acquires Simbamanyo Properties

Dr. Sudhir Ruparelia, the Chairman of RUparelia Group, who doubles as the Honorary Consul of Nepal to Uganda, acquired Simbamanyo House, a prime property along Lumumba Avenue in the centre of Kampala at Shs 18.5bn after Peter Kamya ‘allegedly’ failed to pay a bank loan he had acquired from Equity Bank.

Sudhir’s associates said the acquisition through the investment arm of the Ruparelia Group of Companies followed a public auction put up by Equity Bank which sought to recover an unpaid loan of $8.1 million from Simbamanyo Estates.

Afrique Suites, which were also owned by former Simbamanyo Estates owner, Peter Kamya, were sold by Equity Bank to Luwaluwa Investments Ltd which belongs to a Supreme Court clerk.

Kamya says the sale and transfer “were unduly and designedly rushed as they were all done on 8 October, 2020 in just a space of 2 hours.”

He also maintains that the act of selling and disposing of the suit properties and businesses was a “premeditated act of explicit and implicit collusion and connivance between Equity Bank, Meera Investments and Luwaluwa Investments as it was not reasonably possible to ordinarily find and negotiate with buyers ready to pay for such large commercial properties within 2 hours.”

Background

It all started when Kamya sued Equity Bank Uganda together with Equity Bank Kenya Ltd and Bankone Ltd, a Mauritian Bank seeking orders and declarations to declare that the contested credit facility of 30 November 2017 was illegal and for orders to cancel/discharge the mortgages created thereunder.

According to court documents seen by this website, Simbamanyo says “despite the pendency of the suit”, Equity Bank “commenced measures to enforce the mortgages” created under the disputed credit facility which enforcement was unsuccessfully resisted by the property owners.

Kamya said following the Court proceeding on 7 September 2020 before the trial Judge Hon. Boniface Wamala, Equity Bank lawyers issued another notice of sale of the suit properties in an act of continuation of the sale process which had been injuncted by Court.

Additionally, Simbamanyo said its lawyers published a notice in the Daily Monitor of 8 September, 2020 under the title “Response to caveat emptor” where they further confirmed that the suit properties would be sold by 8 October, 2020 unless Equity Bank paid 30% of the disputed amounts.

On 8 September, 2020, Kamya and Simbamanyo lodged and registered caveats as registered proprietors on Simbamanyo House and Afrique Suites respectively to protect their interests as a result of Equity Bank’s threat to sell their properties.

Kamya further filed a notice of appeal against the said High Court order of 7 September, 2020 and wrote a letter requesting for proceedings which were served to Equity Bank’s Counsel on 1 October, 2020.

Contention

Through lawyers, Muwema & Co. Advocates and Kakuru & Co. Advocates, Kamya said “for all intents and purposes, Equity Bank was at all material times aware that they were aggrieved by its plans to sell its mortgaged properties” and that they were pursuing a remedy through the appeal process.

“Despite having knowledge of the Plaintiff abovementioned appeal process and the existence of the Plaintiffs’ caveats on the suit properties, the Defendant (Equity Bank) through its agents M/s CL Risk Management Services proceeded to sale and cause the transfer of the suit properties to Meera Investments and Luwaluwa Investments,” said Kamya.

Kamya said in the night of 14 October, 2020, Sudhir’s Meera Investment “forcefully gained entry into Simbamanyo House by breaking all padlocks, locking up the Simbamanyo’s offices on the property, chasing away its security guards, deploying their own guards and have since exercised dominion and control over the property and business.”

Sudhir, a controversial businessman, previously owned Crane Bank which was taken over and sold by the Central Bank on grounds that it was run down – a claim he denies.

Sudhir is the proprietor of Commonwealth Resort Munyonyo, Speke Apartments and other high-end properties previously owned by Asians forced into exile by Idi Amin in the 1970s.

Kamya further said on 15 October, 2020 Luwaluwa Investments also forcefully gained entry into Afrique Suites where they sealed off the premises, deployed their own security guards and have since exercised dominion and control over the business.

Inventory

Kamya said Meera Investments and Luwaluwa Investments did not take an inventory of the Plaintiffs trade fixtures and assets which were found on the premises when they took possession and yet they did not buy the Plaintiffs business as a going concern.

He further said the market value of Simbamanyo was in the region of US$ 12m and the market value of Afrique Suites was in the region of US$ 11m but Equity Bank sold the said suit properties at an undervalue to recover an alleged and disputed debt of US$ 10.5m.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.