Kampala, (UG):- Uganda’s Minister for Finance, Planning, and Economic Development, Hon Maia Kasaija has announced the new interest rate cap of 2.8% per month and 33.6% per annum on loans issued by microfinance institutions and moneylenders to borrowers.

The decisive move which according to government aims to protect borrowers and regulate lending practices comes into effect after the recent passing of the Tier 4 Microfinance Institutions and Money Lenders Bill 2024 that came with the clause under Cap. 61 of the legislation.

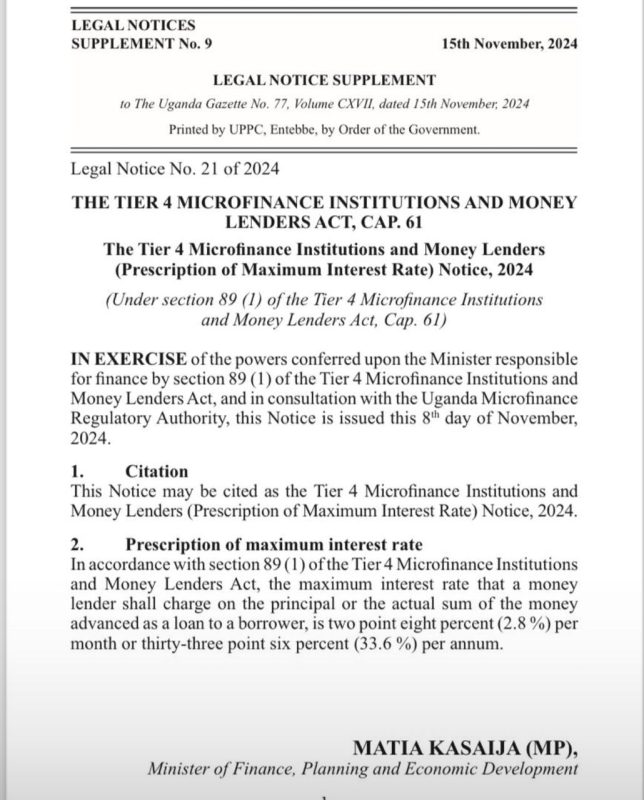

“In accordance with section 89 (1) of the Tier 4 Microfinance Institutions and Money Lenders Act, the maximum interest that a money lender shall charge on the principal or the actual some of the money advanced as a loan to a borrower, is two point eight per cent (2.8 per cent) per month or thirty -three. Six per cent (33.6 per cent) per annum,” Minister Kasaija stated in a gazetted notice made public on November 15th 2024.

This development also comes into effect after President Museveni’s recent condemnation of exploitative lending practices where he decried the high interest rates imposed by money lenders, describing them as a significant threat to Uganda’s economic stability if left unregulated.

“The inflation rate in Uganda is very low. It is only 3%—even lower, but you find people charging 240% in an economy where the inflation rate is only two per cent. Why do you do that? Museveni questioned during the 8th Annual Conference of the Southern and Eastern Africa Chief Justices Forum in Kampala.

The President reaffirmed the government’s commitment to introducing more robust laws and specific regulations to govern money lending practices, promising that these measures would shield Ugandans from predatory lending and ensure economic fairness.

And now Minister Matia Kasaija, who signed off the gazetted notice on interest rates for moneylenders and micro-finance institutions says the government is committed to addressing such loopholes highlighted by the President, starting with the interest rate cap.

The minister emphasized that the capped rates were part of broader efforts to foster financial inclusion and protect vulnerable borrowers, particularly small-scale entrepreneurs who rely on microloans for their livelihoods.

Although the Uganda Microfinance Regulatory Authority was licensing the Tier 4 Microfinance Institutions and Money Lenders, it has not been in a position to cap the interest rate they charge their clients. As such, these microfinance institutions and money lenders could come up with their own interest rates, which were too high, hence resulting in borrowers failing to pay and in the end, losing their properties.

However, the Legal Notice Supplement Number 9 states that in the exercise of the power conferred upon the Minister responsible for finance by section 809 (1) of the Tier 4 Microfinance Institutions and Money Lenders Act, and in consultation with the Uganda Microfinance Regulatory Authority.

Now the government has tasked the Uganda Microfinance Regulatory Authority (UMRA), which consulted on the directive, with ensuring compliance across the sector to implement the new law for which lenders failing to adhere will face penalties as outlined therein.

Send us your story or opinion on: dailyexpressug@gmail.com. You can also follow Daily Express on WhatsApp for all the latest news and updates.