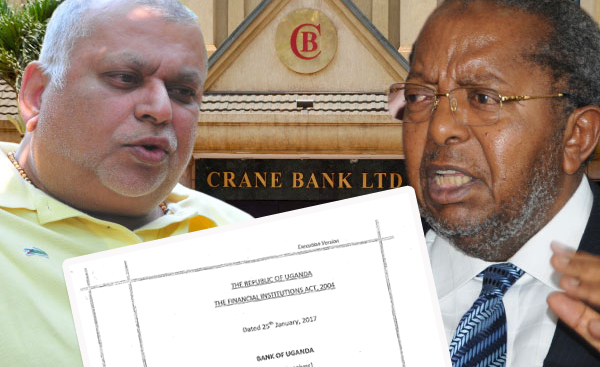

It is almost a week now since five judges at the Supreme Court in Kampala quashed with costs an application filed by Bank of Uganda (BoU) in an attempt to file more affidavits to challenge the decision by the High Court that ruled in favour of city tycoon Dr. Sudhir Ruparelia and his Meera Investments Ltd.

The defeat at the Supreme Court comes as the latest blow in a myriad of cases that the central bank has lost in court to Dr. Sudhir. With every defeat in court, the Central Bank continues to lose trust and credibility, two virtues that are very critical in the capital markets.

The many losses have led to questions over why BoU continues to pour taxpayers money in pursuit of cases that it is always sure to lose to Dr. Sudhir.

” It is now an issue of ego. There are some people here (at BoU) who feel humiliated by the many losses but they still keep on suing Dr. Sudhir,” an official in BoU’s Legal Department, told us in confidence.

The Legal Department at BoU is split between a majority that argues that the central bank should eat humble pie bad accept that there are no winnable cases against Dr. Sudhir, and a minority that believes in fighting a lost war.

In its report, Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises(Cosase) warned that BoU’s relationship with lawyers from MMAKS Advocates is questioned.

Documentation in Parliament points to possible collusion between lawyers and BoU’s Legal Department, leading to many cases where billions of shillings are exchanged.

MPs have continuously argued that BoU has no sound case against Dr. Sudhir and that instead of wasting taxpayers’ money on bogus cases, BOU should concentrate on fiscal and monetary issues.

Financial experts have also warned that the continuous legal defeats of BoU at the hands of Dr. Sudhir will further undermine the already-eroded credibility of the central bank, thus escalating its inabilities to controlling fiscal policy.

With all these crushing defeats, experts have also warned that the trust of the Bank in auctioning Treasury Bonds and Bills could be affected by the loss of trust, further crippling Government efforts in mobilizing revenue.

In a very unscrupulous move, the Central Bank had run to the Supreme Court in a bid to substitute Crane Bank in Receivership with Crane Bank in liquidation.

However, the petition was unanimously dismissed by the five Supreme Court judges who ruled that the change would fundamentally alter the facts of the case and deny both Dr. Sudhir and Meera Investments a fair hearing.

The attempt by BoU to switch parties in the case dates back to October 2016 when the Central Bank took over the assets and liabilities of Crane Bank Limited before selling them to Dfcu.

Subsequently, BoU-through Crane Bank in Receivership sued Dr. Sudhir and Meera Investments.

However, the case was dealt a bruising blow after Dr. Sudhir successfully argued that Crane Bank in receivership had no basis for suing.

Do you have a story or an opinion to share? Email us on: dailyexpressug@gmail.com Or follow the Daily Express on X Platform or WhatsApp for the latest updates.