Ugandans who Tuesday thronged the Supreme Court as the highest judicial organ began proceedings to determine whether Bank of Uganda pays property mogul legal Sudhir Ruparelia costs, concluded that the Central Bank’s team is either incompetent or intending to cause loss of taxpayers’ money.

Sudhir through his lawyers took on BoU in the Supreme Court after the regulator made a U-turn on payment of legal costs despite withdrawing an appeal in Appellate Court and agreeing to meet the costs last year in September.

It is against this backdrop members of the public who filled the courtroom to the brim- seemingly questioned the competences of BOU legal officers led by Margaret Kasule- whom Sudhir has since sued in an individual capacity.

Inside fresh Court Battle to Recover Costs

Back to 2016, BoU, at the end of October directed by Deputy Governor, Dr Louis Kasekende and Director of Commercial Bank Supervision, Justine Bagyenda, in the exercise of their statutory powers, seized Crane Bank, at the time, one of the top 5 banks in the country. On the 24th of January 2017, BoU sold the assets of Crane Bank Limited to dfcu Bank.

This was just 4 days after placing the bank under receivership, on 20th January 2017― a process that would later be declared by a parliament of Uganda investigation to have been casual and without valuation.

Parliament also discovered that Crane Bank was sold at a give-way price and at terms that cost taxpayers nearly UGX40 billion in losses.

Following the closure and hurried sale, in another shoot-first-and-aim-later move, BoU, clothed as Crane Bank (In Receivership) amidst so much fanfare and chest-thumping on 30th June 2017 dragged one of the shareholders of Crane Bank, Dr Sudhir Ruparelia and his Meera Investments Ltd- seeking to recover an alleged UGX397 billion

The central bank and its band of heavily paid lawyers would however learn a bitter and expensive legal lesson- when Hon. Justice David Wangutusi of the Commercial Court dismissed their case- reminding them that the same Financial Institutions Act 2004, which they had relied on to close Crane Bank, also said that a Bank under receivership cannot sue or be sued for that matter. Justice Wangutusi dismissed with costs, BoU’s case as being barred in law.

In the ruling delivered on the 26th day of August 2019, Justice Wangutusi belaboured to teach BoU and their lawyers- that while the FIA 2004 only allows receivership to go on for a maximum of 12 months, in which case, Crane Bank (In receivership) as a legal entity would have ceased to exist, on 20th January 2018, the moment the central bank sold Crane Bank (In Receivership) to dfcu Bank, on the 24th of January 2017, there was no more Crane Bank (In Receivership)

“In my view, the Receivership was exhausted with that transfer and conveyance. The Respondent (Crane Bank (In Receivership), therefore, had no locus standi to file any suit claiming any property because it had ceased to exist. Nonetheless, the Receivership would have in any case expired by now within 12 months from 24th January 2017,” ruled Justice Wangutusi.

“The sum total is that the Respondent (Crane Bank (In Receivership)) at the time it filed this suit was not in existence, its lifetime having been terminated when it was surrendered to DFCU Bank whose consideration was the DFCU assumption of the Respondent’s liabilities which assumption was paid by conveying her assets to DFCU Bank,” he added.

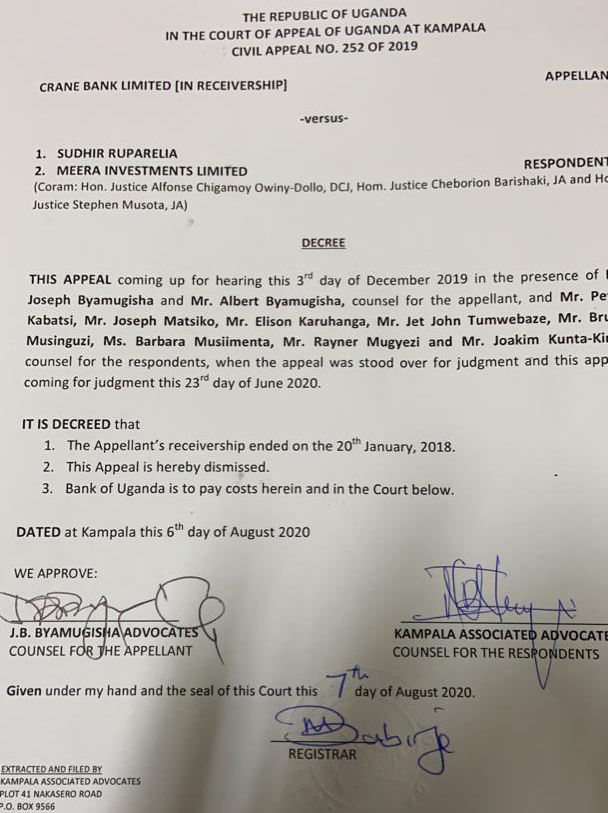

In what many legal analysts said was a tail-chasing and expensive mistake, the Bank of Uganda, again, under the veil of Crane Bank (In Receivership) would go on to appeal in the Court of Appeal. In another shocking, but probably expected defeat, the coram of three Court of Appeal Justices― Alphonse Owiny Dollo; Cheborion Barishaki and Stephen Musota unanimously dismissed all of Bank of Uganda’s 9 grounds of appeal. They too agreed that a bank In Receivership, under the Financial Institutions Act (2004) cannot sue or be sued and therefore Crane Bank (In Receivership) cannot and should not have sued businessman Dr Sudhir Ruparelia and his company Meera Investments.

BoU was also ordered to pay costs, both at the Court of Appeal and the courts below.

Indeed, BoU, through its lawyers, Dr Joseph Byamugisha (R.I.P) agreed to a Court of Appeal, decree on the 7th of August 2020 to pay costs in the Court of Appeal and the Courts below. It was decreed that the appellant’s receivership ended on the 20th January 2018 and that the appeal would be dismissed and that “Bank of Uganda is to pay costs herein and in the Court below.”

BoU goes to Supreme Court

Despite the decree in which it agreed that Crane Bank (In Receivership) had ceased to exist, the Central Bank still masquerading as Crane Bank (In Receivership), appealed to the Supreme Court vide Civil Appeal No. 07 of 2020.

With two losses, and with a new law firm— JB Byamugisha Advocates, the Central Bank made a move to this time put Crane Bank, under liquidation. In a notice published in the Sunday New Vision newspaper of 15th November 2020, the Central Bank announced, it had now progressed Crane Bank (In Receivership) into Liquidation. While the move was intended to allow the Central Bank, this time as Crane Bank (In Liquidation), to sue Dr Sudhir and his Meera Investments, the move came almost three years late as a Coram of 5 Supreme Court justices would once again remind the Central Bank and its lawyers.

This was contained in their ruling on a Central Bank Supreme Court application, to substitute Crane Bank (In Receivership) with Crane Bank Limited (In Liquidation).

While BoU in August 2021 withdrew its case against Dr. Sudhir Ruparelia and accepted to pay costs, it is now playing legal games on its court costs.

The 5 Justices― Rubby Aweri Apio, Faith Mwondha, Dr Lillian Tibatemwa, Ezekiel Muhanguzi and Percy Night Tuhaise, in their 12th August 2021, ruling unanimously dealt a death blow to Bank of Uganda’s fresh legal manoeuvre. The Justices, flatly told BoU that their application, if allowed, would “definitely prejudice” Dr Sudhir and Meera Investments, causing them “injustice.”

They also ruled that the Bank of Uganda’s application was in bad faith since it was made with the full knowledge that it would circumvent justice.

“The application, in our considered opinion, is made mala fide (carried out in bad faith or with intent to deceive), to deny the respondents their defence at appeal that a bank under receivership cannot sue,” reads part of the ruling.

The justices also reiterated that in law, Crane Bank Limited (In Receivership) and Crane Bank Limited (In Liquidation), and Crane Bank Limited are three distinct entities with different rights, powers, and obligations.

Withdrawing Bad Case

Following the several court losses, the Bank of Uganda still representing herself as Crane Bank (In Receivership), wrote to the Supreme Court to finally withdraw its case- its appeal.

“Take notice that the Appellant does not intend further to prosecute the appeal. Take further notice that the Appellant will pay the costs of the appeal and in the courts below to the Respondents,” read the notice filed by BoU to the Supreme Court on 15th September 2021.

But here is the catch. BoU is trying to avoid paying the costs directly. It instead wants Crane Bank (In Receivership) to be the one to pay the costs. However, Crane Bank (In Receivership) by order of both the Court of Appeal and the Supreme Court stopped being a financial institution on the 20th of January 2018 when receivership ended. It is therefore no longer under the control of the Bank of Uganda and therefore Bank of Uganda’s attempt to divert its legal liabilities is not only illegal but also in contempt of court.

This is why Dr Sudhir Ruparelia and Meera Investments have applied to the Supreme Court to have it explicitly order the Bank of Uganda and not Crane Bank (In Receivership) to pay the costs of this 5-year legal battle.

“What we want is the court to order Bank of Uganda to pay the costs in the Supreme Court. Because the costs in the high court and the supreme court are already determined- the bank of Uganda must pay those. In addition, it must pay these (in Supreme Court),” Peter Kabatsi, the Senior Partner at Kampala Associated Advocates (KAA), Sudhir’s lawyers told the media yesterday outside the Supreme Court, minutes after the highest Court in the land said it would give its ruling on who should pay, on notice.

“They had appealed against the decision of the Court of Appeal, and they withdrew that appeal. They want to walk away without paying the costs. They must pay the costs,” added Mr Kabatsi.

In another media interview, Dr Sudhir also said, that it was important that the Bank of Uganda pays for its mistakes.

“They’re trying to play a smart game. Crane Bank In receivership ended on 20th January 2018. Crane Bank is no longer in the control of the Central Bank, it is back to the shareholders,” Dr Sudhir told journalists outside court.

“What they’re trying to do is to play a legal game. They want us as Crane Bank limited to pay our own costs,” he said adding: “The people who brought the suits is the Bank of Uganda.”

He also said chided BoU for continuing to be in contempt of court by misrepresenting itself as Crane Bank (In Receivership).

“The Supreme Court has said they are in contempt of court because every court ruling and every court order they have not obeyed, deliberately, incomplete, complete, contempt of court. This is further contempt of court,” he said.

It shall be remembered that in the 12th August 2021, ruling, the Supreme Court found Bank of Uganda in Contempt of Court, over continuing to purport itself to be and or represent Crane Bank (In Receivership). The Supreme Court reaffirmed an earlier Court of Appeal decision that found that since Crane Bank was no longer In Receivership, it was no longer a financial institution and therefore no longer under the control of the Central Bank.

“The attempt at circumvention of the decision of the Court of Appeal by altering the status of the 1st respondent from Crane Bank (In Receivership) to Crane Bank (in liquidation) was in our view aimed at impeding or perverting the course of justice before this court and the same amounted to contempt,” the justices observed.

“A declaration doth issue that the 2nd respondent (Bank of Uganda) is in contempt of court orders,” the Supreme Court ordered.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.