Diamond Trust Bank (DTB) had earlier admitted committing illegalities at high court on court records, the bank has additionally at supreme court admitted failure of the Court of Appeal to address the substantial point of illegality hence Ham has applied and awaits judgments on count of the Bank’s admissions.

BIG STORY: In a twist of events, Businessman Hamis Kiggundi alias Ham has filed an application to the Supreme Court requesting for a judgement on what he Insists Diamond Trust Bank (DTB) admitted to committing illegalities on appeal in a sh120bn case.

The multibillion case and commercial dispute is between Hamis Kiggundu alias Ham and DTB over loans that he borrowed from the bank which the businessman accuses the bank of debiting his account without his knowledge.

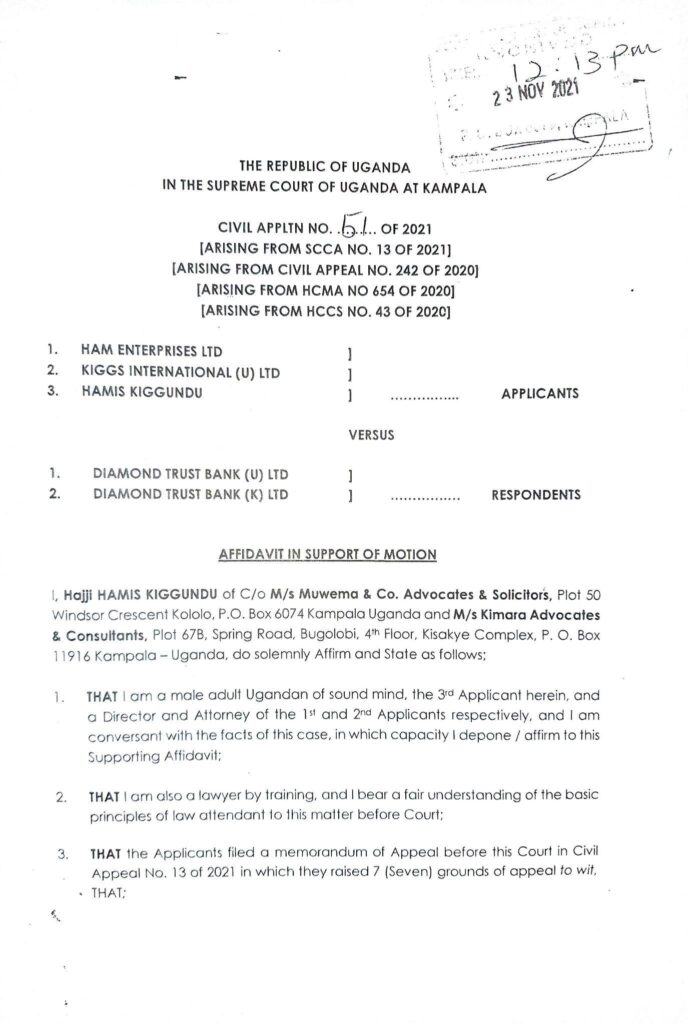

In an application filed in the Supreme Court on Tuesday, November 23, Kiggundu asserts that the bank agreed with him that the Court of Appeal (COA) justices – Deputy Chief Justice Richard Buteera, Christopher Madrama, and Kenneth Kakuru — did not address the issues of illegality in conducting financial institutions business in Uganda, contrary to the provisions of the Financial Institutions Act.

Kiggundu also adds that he and the bank faulted the justices for abandoning the rounds raised at COA and regularly introducing new grounds of appeal that were implicitly set out in the memorandum of appeal to rive to its decision, and at the justices erred in ut and law, in finding that B was never heard by the trial court before their joint written statement of defence as struck out and judgment entered in his favour. The same admissions, according to Kiggundu, are repeated in DTB’s supplementary submissions filed in the Supreme Court.

“On the whole, the thrust of DTB’s arguments and submissions in this appeal, amounts to a clear, unequivocal and positive admission to the grounds I raised,” Kiggundu submits.

The businessman made the appeal before Chief Justice Alfonse-Owiny Dollo, Justices Rubby Opio Aweri, Faith Mwondha, Mike Chibita and Percy Tuhaise.

Kiggundu submits that there is no dispute for the Supreme Court to determine in respect of the admitted grounds and the appeal ought to stand settled in his favour. However, the lawyers representing DTB received the application in protest, saying it has not been signed by the Supreme Court registrar.

DTB is being represented by Edwin Karugire and Usama Sebuufu, while Fred Muwema, Arnold Kimara and Mathew Kiwunda are representing Kiggundu.

DTB AFFIDAVIT In their supplementary affidavit, DTB contends that the COA struck out the amended plaint that raised

AFFIDAVIT

Background

Kiggundu, through Muwema & Co Advocates and Kimara Advocates, jointly sued Diamond Trust Bank-Uganda (DTB-U) and DTB-K for unlawfully making deductions of Shs 120bn while servicing a loan from the duo. A counter by DTB to have him first pay 30 percent of the loan was halted by court and now it is moving to clear the air on the lawfulness of the transaction.

Ham claimed that between February 2011 and September 2016, his two companies acquired loans from the two sister banks and deposited commercial properties as security.

He said along the way the banks did not remit the full amount but deducted it from his accounts in purported repayment.

The banks denied any breach of contract and said the loans were duly taken by the businessman’s companies and the deductions from his bank accounts were lawful and for repayment of the credit facilities.

The bank lawyer, Mr Kiryowa Kiwanuka, listed the loan facilities taken by Ham Enterprises as $6,663,453, Shs1.5b, Shs1b, $4m and $500,000.

Brief History

Ham Enterprises (U) Limited (The company) and Diamond Trust Bank (The Bank) had a 10 Year long term Banking relationship where Ham Enterprises (U) Limited as the client made huge transactions on its accounts with the bank equally extending Loan facilities to the company and the company would promptly pay off these loans until an outstanding balance of USD 10,000,000 (United States Dollar – Ten Million only) which the company claims was not reducing despite having paid huge amounts of money towards loan clearance over time.

The company therefore decided to carry out a figurative and legal Audit on all its accounts through which Audit report from the company’s accounts and Loan statements availed from the Bank records revealed that all loans were already paid to zero balance and instead the Bank had excessively unlawfully debited Ugx – 34bn and USD 23m from the company’s accounts over that spread period of time.

The legal audit furthermore revealed that Diamond Trust Bank was carrying out illegal transactions in a bid to avoid paying government taxes contrary to the laws of Uganda specifically as guided by the Financial Institution Act and equally contrary to the Bank of Uganda customer consumer protection guidelines.

On 17th Jan 2020, Ham Enterprises (U) Limited hence filed a suit at the commercial court for recovery of the excessive money unlawfully debited from its accounts, equally bringing these acts of illegalities committed by the Diamond Trust Bank to the court’s attention.

On 7th October 2020 judgement was entered against the Bank based on fact that the Bank on-court record admitted to committing illegalities by carrying out financial institution business in Uganda without a license as required by section 117 of the Financial Institution Act, and DTB Uganda acting as DTB Kenya Agent without approval in contravention of Regulation 5 Of The Financial Institutions (Agent Banking) Regulations 2017 and Section 126 (3) of the Financial Institutions Act as well as the relevant laws of Kenya making the bank to become a principal offender as provided for under section 19 of the Financial Institutions Act having taken part in and facilitated the commission of an offence. There was also no counterclaim by Diamond Trust Bank in regard to any outstanding unpaid loans by Ham Enterprises (U) Limited to the Bank. The judgment equally directed the bank of Uganda to protect the Ugandan economy from illegal hemorrhages and uncontrolled flows of financial resources and to ensure that financial institutional business in Uganda is operated within the letter of the law to protect the nascent banking business industry in Uganda

On 20th October 2020, The bank appealed against the judgement of the commercial court on grounds that there was no illegality committed contrary to the Financial Institution Act

On the 5th May 2021 a panel of three Honorable Judges headed by Hon. Justice Richard Butera, Hon. Justice Kenneth Kakuru and Hon. Justice Christopher Madrama ruled in favor of the Diamond Trust Bank, setting aside the High Court judgment without addressing the issue of illegality despite it being the substantial ground of appeal as filed by Diamond Trust Bank. The Court of Appeal concluded by ordering a retrial at the high court while excluding the amended plaint that had raised the point of law of illegality committed by Diamond Trust Bank thereby promoting and shielding the illegalities as committed by the bank contrary to the Financial Institutions Act.

On the 10th June, 2021 Ham Enterprises (U) Limited appealed against the court of appeal decision at the supreme court

On 12th November 2021, the supreme court allowed the bank’s request to highlight submissions on grounds not contained in their memorandum of appeal on a matter not subject of appeal and parties were asked to submit on the same within 13 days. Diamond Trust Bank in their Submissions admitted that the Court of Appeal failed to address the Substantial point of illegality upon which judgement was rightfully entered at the high court specifically stating in their submissions that: “The learned Justices were entitled to first deal with the grounds regarding the procedure adopted by the trial Judge in striking out the defendants’ pleadings and granting the impugned orders before dealing with the other grounds” and on 23 November 2021, Ham applied and awaits judgement on the admissions by the Bank.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.