KAMPALA, UGANDA: Members of Parliament (MPs) have approved the government’s proposal to borrow $464 million (approximately Shs1.7 trillion) to pay the budget’s infrastructure and development needs, despite objections from the opposition, which claims the loan terms are unjust.

This comes after the Minister of Finance Hon Matia Kasaija last month presented a formal proposal to parliament requesting to allow the government to borrow this money to cover budget gaps.

On Tuesday, the request was referred to Parliament’s National Economy Committee.

According to documents tabled before the committee, the loan will be provided by Standard Chartered Bank, which will act as “the lead arranger and agent” for Nippon Export and Investment Insurance (NEXI), a Japanese insurance firm, and the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), which will provide the money.

Committee Chairperson John Bosco Ikojo and Hassan Kirumira (NUP, Katikamu South), who presented the majority and minority reports, were both concerned about a clause that required Uganda to waive sovereign immunity for assets at home and abroad, implying that lenders could seize the country’s assets in the event of default.

“The committee recommends that the Ministry of Finance should renegotiate the provisions relating to the waiver of sovereign immunity to avoid exposing critical government assets to creditors in case of default,” said Ikojo.

Kirumira also tasked the Attorney General with the same.

“Attorney General needs to renegotiate the terms for Uganda so that we don’t sacrifice the country’s sovereignty and key national assets into the hands of the lender; the terms are unfavorable in their current state for a county like Uganda,” he said.

Muhammad Kivumbi, the Shadow Finance Minister, questioned the interest payment on a portion of the loan provided by ICIEC, which, according to Islamic customs, does not accept interest on loans.

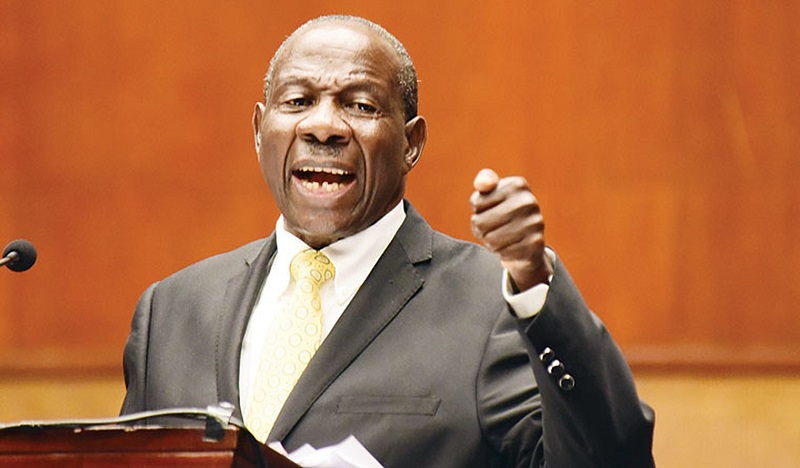

Finance State Minister Henry Musasizi, on the other hand, downplayed the concerns and stated that the government will ensure that the final terms are settled in a way that protects Uganda’s assets.

Concerning the interest payment for the ICIEC portion of the loan, Musasizi stated, “the government of Uganda is dealing with Standard Chartered Bank as the lead arranger; all loans will be from Standard Chartered Bank (SCB), and in effect debt service payment will be to SCB because ICIEC did not make a specific request to the Ministry of Finance.”

He also addressed the issue of sovereign immunity waiver.

“The Attorney General will bargain and conclude; what we are looking at are the financing terms and conditions and all of them have been presented to Parliament,” Musasizi said.

James Kaberuka (NRM, Kinkizi West) said since the Attorney General will renegotiate the terms touching on sovereignty, the loan should be approved.

“Hon Members, you are the ones who will be raising matters of national importance on the state of roads and infrastructure in your area, how do you want the government to finance those projects?” he said.

Musasizi defended the loan request before Parliament’s National Economy Committee yesterday, saying vital projects must be finished and quarterly releases must be supported by cash flow, and that the loan offers the best conditions compared to other available options.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.