With a Parliamentary special committee report recommending the resignation of the board, top management and the line Minister still standing, more trouble is brewing within NSSF as a result of what a long-term saver with the fund turned complainant Waibale Simon Calvin No. 7617700034515 calls ‘creative accounting’ with in contributors’ accounts.

Things will definitely go from bad to worse if Waibale Simon Calvin’s complaints and findings against the fund are found true by the courts of law where he intends to file a case against the fund having had his complaint treated in a rather lacklustre manner by both the fund’s management and the pension sector’s regulator URBRA.

How did it start?

After the NSSF Amendment came into law and was accented to by the President in January 2022, many who qualified for midterm benefits which were one of the key changes included in the new law applied for these benefits including Waibale Simon Calvin in this case.

His application was filed in March 2022 and upon meeting all the requirements, Waibale successfully got his midterm benefits to the tune of over 100 million shillings in May 2022. However, on further scrutinizing his contributions account with NSSF later, he discovered some discrepancies.

What went wrong?

As per the NSSF Act, section 35, the interest of the year which is declared by the Finance Minister is supposed to be applied to the opening balance of a saver’s account at the beginning of the new financial year.

Therefore, according to Waibale’s complaint, his opening balance for the financial year July 2021– June 2022 was 531,000,000 million to which a declared interest of 9.65% was supposed to be applied and credited to his account soon after the Finance Minister’s announcement.

However to his dismay and disappointment that money was not credited to his account in time as required by law making him lose close to 10 million shillings in the process.

His midterm benefits to the tune of 107,781,221 million shs were paid out in May 2022 before the interest was applied to the balance in the account leaving a balance of 431,124,882 million shs onto which the 9.65% interest was applied culminating into an interest payment of 41,603,551 on 1st October 2022. That figure according to the complainant is 9,637,949 less than what Waibale was due to receive in interest for the financial year 2021-2022 had this interest been credited in time at the beginning of the financial year.

And to confirm all is not right with the way entries are done into the accounts of savers, NSSF went ahead and made new entries into accounts from financial years that were already closed off which is not allowed as per acceptable accounting standards before paying out Waibale’s mid term benefits which in itself borders on illegality call it ‘creative accounting’.

Raising an alarm

After noticing these discrepancies, Waibale raised the issues with NSSF’s complaints desk on email in September 2022 to which the reply was a confirmation that not only was NSSF carrying out ‘creative accounting’ by going back to closed-off accounts as far back as the early 2000s to input entries and transactions in a bid to advantage the fund over the contributor, they had also committed fundamental illegality in both accounting standards, principles and law.

Besides the entries into closed-off accounts, this ‘creative accounting’ according to the complainant not only gave NSSF the opportunity to apply the 9.65% interest declared for the financial year 2020-2021 on a much-reduced balance, it was also credited to the customer’s account much later on October 1st 2022 which is a different financial year from July 2021- June 2022 when it was supposed to be credited.

This highlighted another form of negligence which borders on illegality given it took the fund over a year from the time of declaration to remit these funds.

Failure of NSSF and URBRA to fix the discrepancies

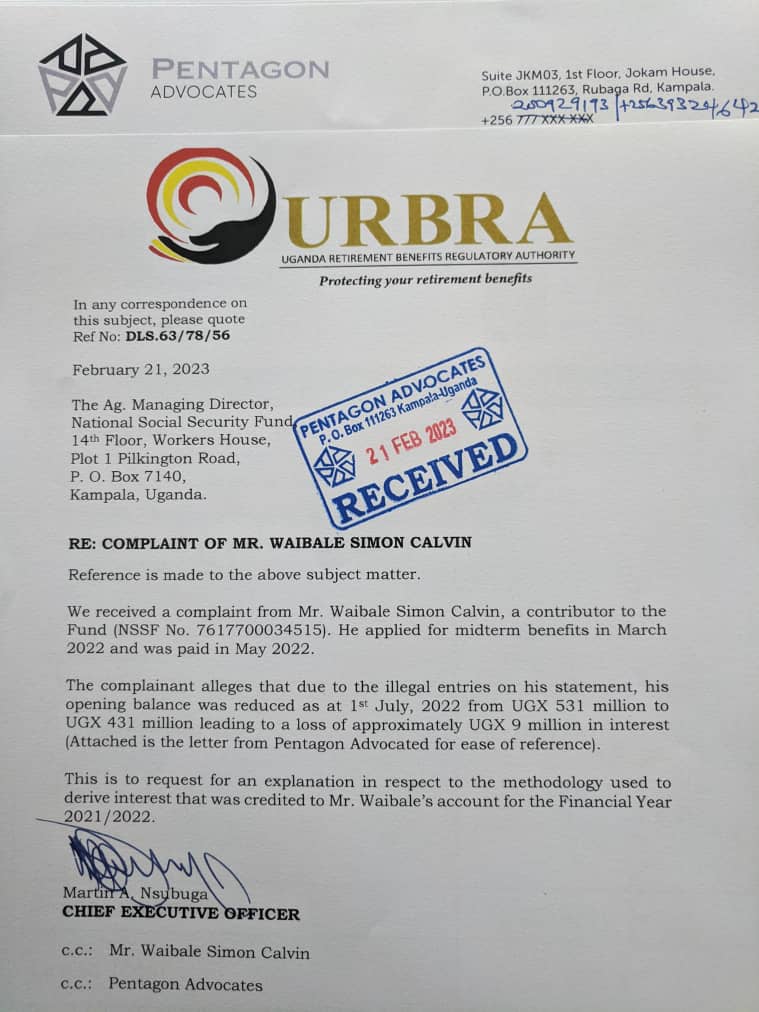

On failing to have his queries rectified by NSSF given their email response showed they have no problem with the anomalies they had carried out in Waibale Simon Calvin’s contribution account, he contacted his lawyers Pentagon Advocates who penned a complaint to the sector’s regulator URBRA in December 2022.

“The Uganda Retirement Benefits Regulatory Authority then referred the issue back to NSSF with a copy of the letter inquiring into the discrepancies raised being sent to Pentagon Advocates in February 2023.

NSSF in response replied to URBRA and copied the complainant as well indicating they had followed the right procedure and ignored the pertinent issues raised by Waibale Simon Calvin leaving us with no option as his lawyers to seek justice in the courts of law” said Louis Kizito of Pentagon Advocates the Lawyer of the complainant.

The Counsel to the Complaint has since gone ahead and served NSSF with a notice of intention to sue as they are set to take the matters raised to court for determination.

NSSF Responds

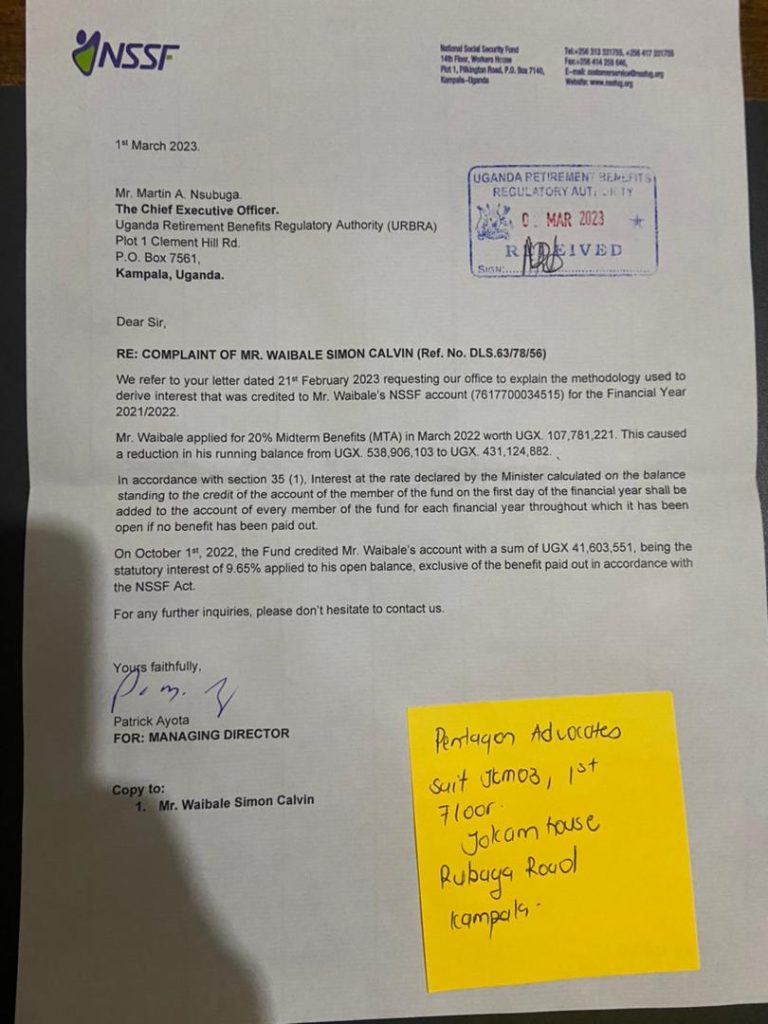

The NSSF acting Managing Director, Patrick Ayota in a response seen by this website explained that Mr Waibale didn’t qualify for the 2022 interest since he was applying for benefits in the same year.

“Mr Waibale applied for 20% Midterm Benefits (MTA) in March 2022 worth UGX 107.781,221. This caused a reduction in his running balance from UGX. 538,906,103 to UGX 431,124,882. In accordance with section 35 (1), interest at the rate declared by the Minister calculated on the balance standing to the credit of the account of the member of the fund on the first day of the financial year shall be added to the account of every member of the fund for each financial year throughout which it has been open if no benefit has been paid out.”

Ayota added: “On October 1, 2022, the Fund credited Mr Waibale’s account with a sum of UGX 41,603,551, being the statutory interest of 9.65% applied to his open balance, exclusive of the benefit paid out in accordance with the NSSF Act.”

What are the wider implications?

While Waibale Simon Calvin’s case may be an isolated case, a forensic audit ought to be done in regard to the ‘creative accounting’ highlighted in his complaint on the accounts of all savers who qualified for mid-term benefits. With over 21603 members receiving their midterm benefits by June 1st 2022 and over 421 Billion shillings paid out, a forensic audit may reveal many more if not all recipients of these benefits may be victims of the same discrepancies with the total amount lost by savers and recipients of midterm benefits reaching hundreds of billions after the interest rate of for the financial year 2020-2021 was applied to a balance less than the opening balance for the next financial year 2021-2022 as stipulated by the law after deduction of the mid-term benefits.

Finally, for those who qualified for and received their full benefits in the financial year 2021-2022, these could have missed out on billions of shillings in interest due from the financial year 2020-2021 which was never remitted to their accounts in the time given the accounts may have been closed off after receiving full benefits before October 2022 when the complainant finally received what was due to him in interest supposed to be received at the beginning of the previous financial year.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.