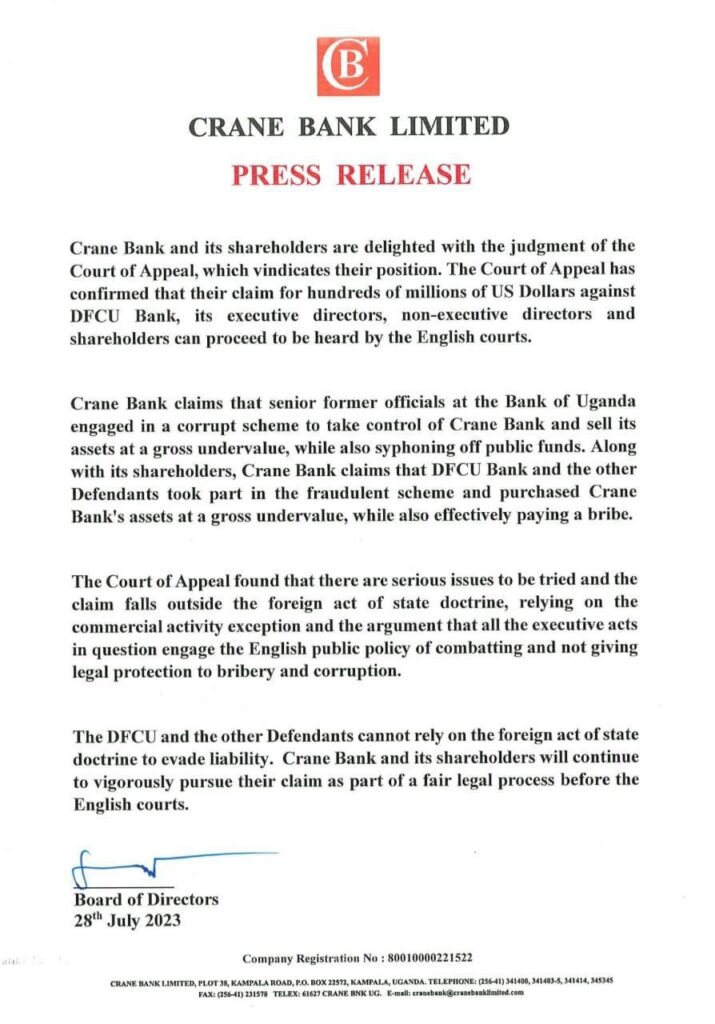

KAMPALA, UGANDA: The directors of Crane Bank Limited have welcomed the recent Judgement of the Court of Appeal in London in the UK which ruled that the case in which Dfcu bank fraudulently purchased CBL assets can be tried in the UK.

The Court of Appeal in London days ago confirmed that the claim of hundreds of millions of dollars against Dfcu bank, its executive directors, non-executive directors and shareholders can proceed to be heard by English courts, something that Dfcu bank, which benefited from the illegal sale of CBL by the Bank of Uganda (BoU) didn’t want and they had been favoured in the lower court in the UK.

Along with its shareholders, Crane Bank claims that senior former officials of BoU engaged in the corrupt scheme to take control of CBL and sell its assets at a gross undervalue while also syphoning of public funds in the guise provided liquidity to CBL in receivership. The corrupt scheme, it is alleged, involved some people receiving bribes.

“The Court of Appeal found that there are serious to be tried and the claim falls outside the foreign act of state doctrine, relying on commercial activity exception and the argument that all the executives act in question engage the English public policy of combating and not giving legal protection to bribery and corruption,” CBL shareholders say in a statement dated Friday, July 28.

Crane Bank claims that senior former officials at the Bank of Uganda engaged in a corrupt scheme to take control of Crane Bank and sell its assets at a gross undervalue, while also syphoning off public funds.

Along with its shareholders, Crane Bank also claim that DFCU Bank and the other Defendants took part in the fraudulent scheme and purchased Crane Bank’s assets at a gross undervalue, while also effectively paying a bribe.

“The Dfcu and other defendants cannot rely on the foreign act of state doctrine to evade liability. Crane Bank and its shareholders will continue to vigorously pursue their claim as part of a fair legal process before the English courts,” a statement published on July 28, 2023, reads further.

The Shareholders say they were elated that the London Court of Appeal’s ruling means that DFCU and the other Defendants cannot rely on the foreign act of state doctrine to evade liability.

“Crane Bank and its shareholders will continue to vigorously pursue their claim as part of a fair legal process before the English courts,” the press statement reads.

Background of the case

It should be remembered that Dfcu bank bought assets of CBL at a mere Shs200 billion in January 2017 without following guidelines laid out in the Financial Institutions Act (FIA), paid in instalments, and without any interest, despite BoU claiming it had invested over Shs470 billion in liquidity support to CBL under receivership.

During the Abdu Katuntu COSASE inquiry, BoU officials failed to account for some of the money, and some officials of the central bank would tell the world that indeed CBL was not supposed to be closed, indicating mafias were behind its sale.

At one time, President Museveni said he had warned BoU officials not to sell CBL, but because of corruption, they could not listen to the Head of State’s advice.

The officials at BoU who allegedly participated in the corrupt scheme included former deputy governor Dr Louise Kaskende and former director of supervision Justine Bagyende, among several others.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.