KAMPALA, UGANDA: The Central Bank of Uganda (BoU) has finally opened up on the landmark defeat sustained last week when the Supreme Court of Uganda directed that it reverts the management of Crane Bank back to its shareholders after establishing that the bank was fraudulently sold out to DFCU Bank in 2018.

In the landmark ruling, the Supreme Court also ordered BoU directly pays costs amounting to billions of shillings to Businessman Sudhir Ruparelia and Meera Investments Ltd, who were being implicated for siphoning money from the bank back then.

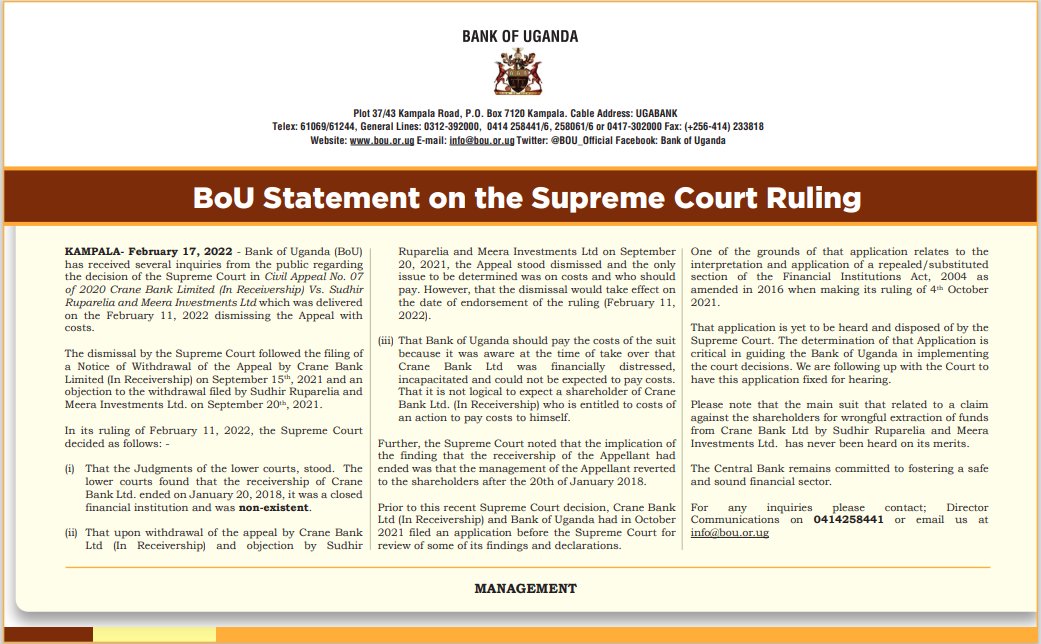

Reacting to the ruling through their official Twitter handle, BoU today released a statement sidestepping key issues in the multibillion case notable of which was that it (Central bank) is still maintaining to pursue one of the grounds to the case which “relates to the interpretation and application of the substituted section of the Financial Institutions Act”.

In a ‘tearful’ statement, BoU states that “the main suit in relation to a claim against the shareholders for wrongful extraction pf funds from Crane Bank…has never been heard on its merits.”

“Please note that the main suit that related to a claim against the shareholders for wrongful extraction of funds from Crane Bank Ltd by Sudhir Ruparelia and Meera Investments Ltd. has never been heard on its merits,” reads a threaded tweet on @BoU_Official’s handle.

However, according to legal analysts, the statement released by Bank of Uganda was ‘limp” and simply trying to save its face after being floored ‘pants down’.

“The Supreme Court had nothing to decide and did not as the would have been appeal was withdrawn by the appellant itself. There is no decision to review,” a lawyer who preferred anonymity told this reporter.

Another analyst said: “It’s a shame that BOU issued such [statement],” adding that once the appeal was withdrawn, all pending applications collapsed.

Background of the case

After selling the assets to DFCU, Bank of Uganda filed a suit under Crane Bank in Receivership against Sudhir and Meera Investments seeking to recover over Shs400 billion and 48 land titles.

The suit by Crane Bank was dismissed by High Court with costs to be paid by Bank of Uganda on the ground that a bank under receivership cannot sue, receivership had ended and Crane Bank was a non-citizen company that could not hold freehold titles.

The Commercial Court in 2019 dismissed the case Bank of Uganda had lodged against Sudhir Ruparelia seeking to recover Shs 379 billion from him. The court, therefore, ruled that Crane Bank was a non-existent entity since it went into receivership three years ago.

Bank of Uganda then appealed to the Court of Appeal challenging the ruling of, an appeal which was dismissed and findings upheld. Thereafter, Bank of Uganda appealed the matter to the Supreme Court.

However, shortly after filing an appeal, BoU sought to withdraw it before it could be heard, prompting Sudhir’s lawyers of Kampala Associated Advocates to object to the withdrawal.

Last week on Friday, February 11, 2022, five justices of the Supreme Court including Rubby Opio Aweri, Percy Tuhaise, Ezekiel Muhanguzi, Prof. Tibatemwa Ekirikubinza, and Faith Mwondha dismissed the appeal by BoU but also directed that the central Bank pay costs in the terms found by the Court of Appeal.

If you would like your article/opinion to be published on Uganda’s most authoritative news platform, send your submission on: [email protected]. You can also follow DailyExpress on WhatsApp and on Twitter (X) for realtime updates.